Auckland property values continue to fall, but holding elsewhere

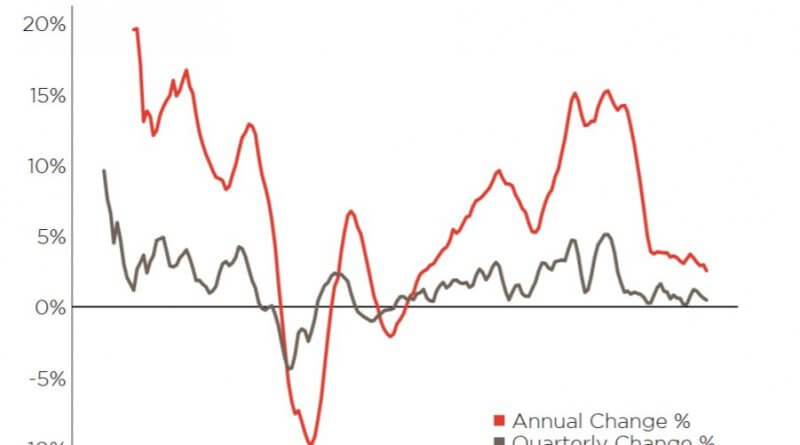

NZ Property values have grown by only 0.5% this calendar year, with the annual rate of growth slowing to 2.6% at the end of last month. For a copy of the detailed report request here:

Corelogic QV House Price Index

According to the CoreLogic QV April House Price Index results, Auckland values continue to fall, with the index dropping 0.4% in March. This takes the annual figure to -1.5%, which is the biggest annual fall since the Global Financial Crisis 10 years ago. For full context though it’s worth noting that aside from minor monthly fluctuation, values have effectively plateaued for two and a half years now and across the Super City the average price is still higher than in September 2016. This is when the property party in Auckland essentially stopped, with funding considerably tightened, both by way of higher loan-to-value ratio requirements and more stringent bank expense testing.

In summarising the current market and outlook, Goodall says: “Not much changed from the prior month in terms of property value change, however the wider property market environment holds its intrigue. The proposed ring-fencing rules relating to loss-making residential investment properties are still working their way through parliament, but if enacted will apply for the current income year (1 April 2019- 31 March 2020) so assuming they pass into law they will need to be understood by investors now (although they won’t file their tax position until next year).”

“Later this month we’ll hear the Government’s official response on the Tax Working Group’s Report, with plenty of interest in their proposals for a more comprehensive capital gains tax for residential property.

Within the next month we’ll also get our first real insight into the impact of the foreign buyer ban from late last year as Stats NZ release their ‘Property Transfer Statistics’ by NZ tax residency for the first quarter of 2019. We’re expecting to see confirmation of the ban’s effectiveness, which the recent reduction in sales volumes had already hinted at – particularly in Central Auckland and Queenstown”.

“And of course – we’ll then look towards the Reserve Bank’s next OCR decision on May 8. Their foreshadowing of a cut at some stage has many economists predicting one as early as the May date and possibly even another before the year is out. All of this illustrates where our focus remains – on the Government and Reserve Bank as opposed to the usual macro-economic factors (mostly benign) and even international pressures (due to our relative insulation at this stage). In the end, the outlook remains one of a gradual easing in property values for the rest of the year”.

For detailed commentary on the March CoreLogic QV House Price Index results for Auckland, Hamilton, Tauranga, Rotorua, Wellington, Dunedin and Whanganui, plus our thoughts on the on the potential future of the Official Cash Rate (OCR) and our overall expected market outlook, read the 2 page commentary – attached.