NZ Vertical Construction Sector fall out – what’s next?

TwentyTwo Director and Advisory and Assurance Lead David Lambie shares his market insights on the future of the New Zealand Vertical Construction Sector.

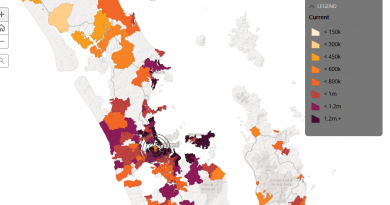

It is no secret the Vertical Construction Sector in New Zealand is going through a troubling period. What does it mean for organisations looking to build, buy or lease in the future? How will the sector adapt to survive?

What is Vertical Construction?

This is a relatively new piece of jargon describing the construction of high rise commercial and residential buildings, as compared to horizontal construction which relates to infrastructure and related construction (under or on the ground).

Where did it all go wrong?

The underlying problem has been risk transfer. Faced with competitive pressures, construction cost risks have been transferred from the buyer to the contractor who in their willingness to secure ongoing contracts and remain competitive have in some cases absorbed an unacceptable level of pricing risk.

Rising material costs. Some contractors, in a hot construction market have been in a catch-22 (a phrase we like!). On the one hand aggressive fixed lump sum tender pricing is required to be competitive (apparently), on the other hand sector demand and the inherent costs associated with New Zealand’s materials supply chain is continuously driving material and sub-contractor costs up. Ultimately for some, this has been unsustainable.

Balance sheet strength. Some organisations just did not have the resources or appetite to absorb the loss or maintain cash flow – a business fundamental.

Quality. Is it possible that quality and standards have been compromised along the way? Is it possible that parts of the industry have recovered losses by stealth? The possibility places enormous pressure on those providing independent or regulatory compliance surety and could be the ‘leaky homes’ of the future.

Did we see it coming?

Not really. If overly competitive pricing and absorbing risk were deemed acceptable corporate policy by some, then there could never be sufficient transparency to critique how organisations choose to respond to the market – until it goes wrong.

It’s unlikely the buyer could have sufficient exposure to a contractor or developers’ fiscal situation to determine if they have the balance sheet strength to sustain cost escalation or complete volumes of work. Maybe the buyer never asked or assumed by reputation that delivery would be certain?

Perhaps we should have predicted that rising costs, excessive demand and rigid fixed-price contracts were not sustainable. Maybe the buyer has acclimatised to the idea that ‘a good old-fashioned competitive tender’ to achieve the lowest price represents the best outcome? When in fact that mindset is completely wrong and represents the greatest risk.

Looking Forward – what we might see?

Demand is rising for construction and new developments across all building sectors. It’s a good sign, but concurrently this growth is likely aligned with recalibrated tendering and selection processes.

Project cost increases. Pricing and tender processes will likely adapt to realistic and sustainable values and therefore transfer cost and risk back to the buyer or end user.

Pricing flexibility or variable fixed sum contracts. No buyer will accept open-ended pricing, but equally the buyer needs measures to avoid inflated fixed pricing which may emerge as an overreaction to the current market.

We like to think there are innovative contractual solutions to achieve price certainty where the parties share the risk around unknown variables or cost escalation. This is optimistically suggested as a means for the contractor to remain competitive/attractive and for the buyer to mitigate conservative pricing (sometimes known as gouging).

Will the market evolve to require contractors to disclose balance sheet strength, provide binding guarantees, step in rights or provide certainty they can withstand cost variations? Very difficult to extract unless competition forces the behaviour.

The rise of non-price attributes. In my view, this will become the most significant adjustment to buyer behaviour. Experience, quality, availability, willingness to partner, contractor / sub-contractor relationships, realistic programme – these are values that must be weighted more heavily than just price. Risk mitigation cannot necessarily be bought (accepting higher pricing) – so the buyer must look deeper into what achieves a successful outcome.

The positives…

Let’s be optimistic for a moment, perhaps some good will come from the demise of some larger construction firms: maybe we will see the redistribution of experienced tradies into other mid-sized and growing firms. Maybe the Crown will make some serious inroads to guiding the industry more effectively and protecting the sub-trades. Maybe the end user will start to consider alternatives and take seriously the non-price attributes that drive great outcomes.

Source: TwentyTwo.co.nz